Welcome to Sharpe Tank. Sharpe Tank was founded by three equity analysts with diverse backgrounds spanning TMT, software, consumer, industrials, and other sectors. We aim to document and share our journey through idea selection, update tracking, and position closing, providing insights and analysis along the way. By doing so, we hope to improve our own portfolio management skills while enabling readers to quickly grasp and follow attractive investment opportunities. Open to feedback and collaborations.

Now we are excited to share our first investment thesis: Sartorius Stedim Biotech.

Sartorius Stedim Biotech

Sartorius is a global leader in sales of equipment and consumables used for manufacturing of biologics or large molecules. They are exposed to secular tailwinds of higher growth for biologics (~10% value CAGR 2023-28) and higher penetration of single-use systems which augurs well for future growth.

For those who are not familiar with the industry, Bioprocessing is the manufacturing process through which cells are scaled up in number in order to filter out and then, harvest specific pieces or output of the cells themselves. This is the process through which biologics, vaccines, antibodies, and now increasingly cell and gene therapies are made through. A good comparable is like semi equipment companies that empower the semiconductor industry, and help its clients with process designs and drug manufacturings from pre-clinical to commercial stages.

The bioprocessing typically consists of two main stages: upstream processing and downstream processing. Upstream processing encompasses all the steps involved in scaling up the production of biological drugs, from laboratory to industrial scale. Downstream processing involves the purification and concentration of the desired biopharmaceutical product through a series of separation and purification steps.

Sartorius boasts a comprehensive vertical integrated portfolio covering the upstream, downstream and media; however, its largest and most lucrative business is in the upstream flow. The company is a global leader in single-use brioreactors. The industry used to use stainless steel bioreactors, but increasingly start to use single-use ones (namely replaceable plastic bags) for several reasons: 1. lower facility set-up cost and timeline to implementation. Construction costs are typically 25-35% lower, time-to-market 30-50% lower. 2.Reduced cleaning and down-time during changeovers and reduced risks of cross-contamination. 3. Smaller manufacturing footprint. Improved facility integrity and flexibility, as well as adaptability. 4.ESG: reduced carbon footprint and utility consumption savings with elimination of cleaning and sterilization processes. Energy costs are typically 55% lower and water cost 65-75% lower.

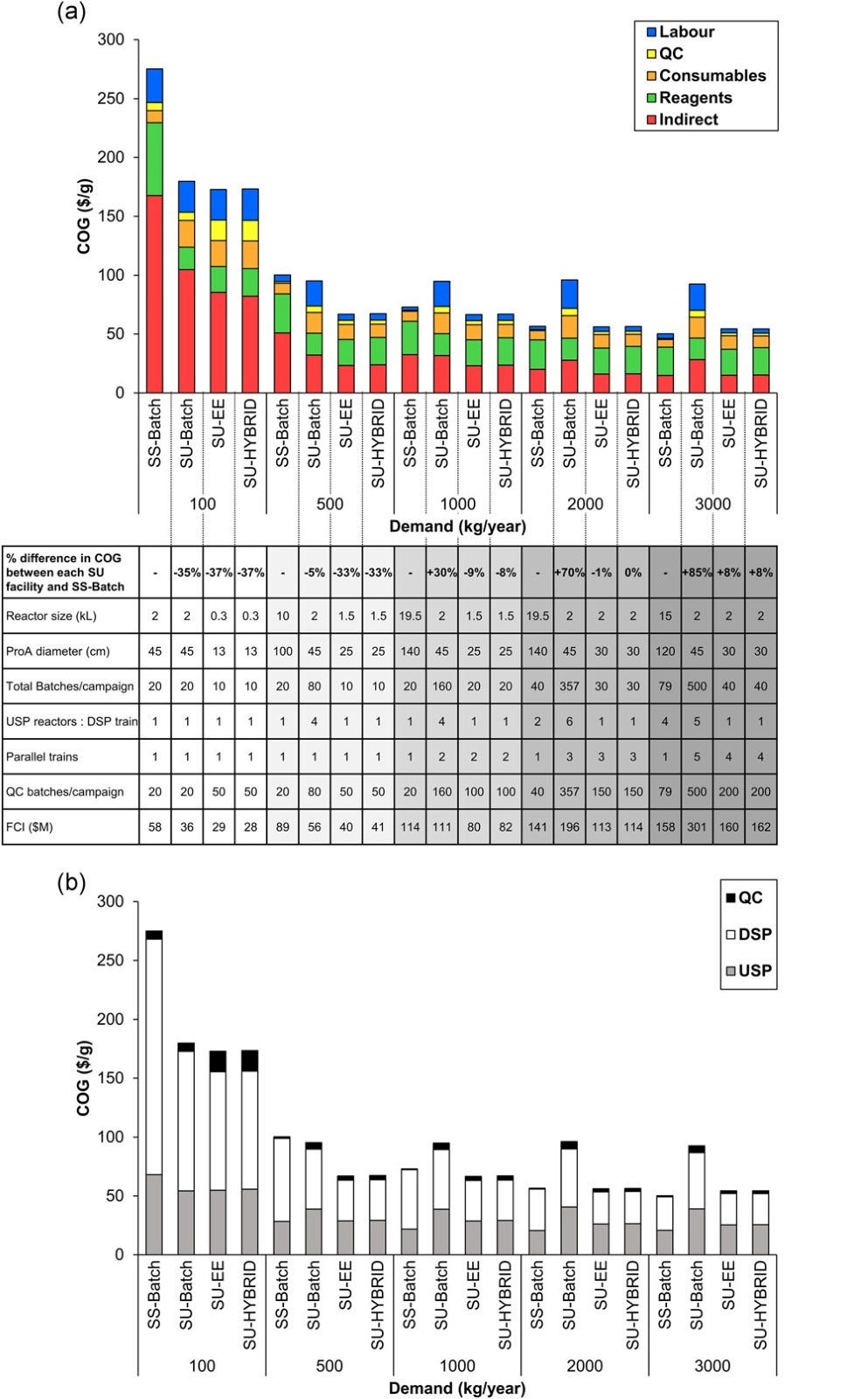

Said that, the rise of adoption does not happen overnight, especially in this conservative industry. The transition must be done in every single part of the process, from upstream to downstream gradually, which is a slow conversion. In addition, there is a cost curve where at the lower end of production volume the more cost-effective option is single-use technologies, but as manufacture ramps up, there is a point at which the volume of throughput dictates that large stainless steel is more cost-effective and less concern of a leak risk.

This research paper has discussed cost comparisons between SUT and stainless steel at different manufacturing scales in details: End-to-end continuous bioprocessing: Impact on facility design, cost of goods, and cost of development for monoclonal antibodies, Mahal et al.

The recent weaknesses

The stock price has been weak during the past 2 years but most concerns are already priced in.

Lower demand for the COVID-19 vaccine, which is clean now given related sales already dropped to zero in 2023.

Falling funding at early-staged biotechs, and pharma cautiousness due to macro uncertainty, which has been gradually changed since late last year and we may see some contribution to kick in by the end of this year with the lag effect.

Inventory correction at customers to balance the excess order intake during Covid. DIM, “we would consider the destocking customers to be largely completed, but maybe not are really finished. We still see some pockets of excess inventories at some customers, but it should decreasingly have an impact on the demand development.” perhaps 1-2 quarters more to fully digest the impacts.

Broad China weakness, which is more controllable given the exposure already dropping from 11% in 2022 to 7% in 2023.

SUT story remains intact

The long term trend of rising SUT penetration remains intact driven by 3 major trend in the biologic industry.

big diseases are fragmented by science/biomarkers, which makes drugs are likely to be smaller end user patients. And the cost deflation for SUT would continue moving forward as manufacturing titres have gone up gradually, which means we can get more drugs from a similar manufacturing volume, which essentially makes SUT even more appealing.

most new modalities require smaller volumes. C&G therapies mostly will go to SUT due to small volume required and scaling-up difficulties. ADCs mostly will go to SUT due to small volume and higher requirement of the safety and cross-contamination because of the toxic components. mRNA typically does not require SUT but SUT will become advantageous in scenarios requiring rapid and flexibile production such as Covid-19.

Biosimilars: an incremental tailwind as several blockbuster drugs are losing exclusivity in recent years. Biosimilars will require smaller volumes with more flexibility and the market is highly price sensitive. It is therefore likely that some biosimilar manufacturers would prefer single-use.

Overall, for growth estimation, the pharma industry is expected to grow at low-to-mid single digit. Biologic market is growing faster at close to 10%CAGR as it continues to take a bigger pie in the industry, and we add SUT penetration on top of that. A mid-teens CAGR growth is expected for a pure play like Sartorius Stedim.

Razor-blade business model and oligopoly market structure

Now, back to Sartorius itself. The best part of the company is its razor-blade business model, and stickiness to its customers, as well as the oligopoly market structure.

Around ¼ of its revenue comes from equipment sales (fermenters for example) whilst ¾ of revenue comes from the sale of single use technologies (filters and bags for example). The gross margin for the equipment side is around 30% while the consumables earns ~60% or higher gross margin.

The company has an intimate relationship with customers and is closely involved with design, implementation, and consultancy of the process for new product development and production. They work with a customer from preclinical trial phase through to commercial production. Once a pharma or biotech commences their clinical process with sartorius' components, those pieces become “spec’d in” guaranteeing a long-term revenue stream. (typically the life time of the product, so around 10-15 years).

The bioprocessing industry is an oligopolistic market, with four main players, Sartorius Stedim Biotech, Merck KGaA, Thermo Fisher and Danaher, compete in any one of the key sub-segments.

Valuation

For the valuation, currently the stock is traded at slightly less than 20x 25E EV/EBITDA, pretty much the trough valuation since 2018. The EBITDA is a good metric to measure the company’s real earnings or its actual ability to generate recurring operating cash flow given its close to 4.6bn goodwill + impairment due to its historical acquisitions. If we add this part of D&A back to its earnings, the estimated 25E P/E would be around 23x, which could easily go to 30x+ for such a high-quality business once the industry recovers -> 50-100% upside in 2 years.

RGA Investment Advisors also use Danaher's valuation to justify Sartorius's, which provides another interesting angle, "Typically Sartorius trades at a decent premium to Danaher due to its pure play status in the highest growth area of the industry and its relatively higher growth rate given the share single use bioreactors are taking from stainless steel. Despite relative growth remaining favorable during the downturn and looking to continue so on the way out, Danaher’s meaningful outperformance has created a unique valuation spread:

Very well written. I'm also considering Sartorius right now. The biggest worry is management incinerating capital with m&a after many perceived polyplus to be expensive. Track record over the years is good though. Long term trends are in tact and right now everything in the TTM numbers look negative.